Getting My Estate Planning Attorney To Work

Table of ContentsThe Single Strategy To Use For Estate Planning AttorneyEstate Planning Attorney Can Be Fun For AnyoneEstate Planning Attorney Things To Know Before You BuyThe 2-Minute Rule for Estate Planning Attorney

Your attorney will certainly additionally help you make your files authorities, scheduling witnesses and notary public trademarks as necessary, so you do not need to fret about trying to do that last step on your very own - Estate Planning Attorney. Last, yet not least, there is valuable satisfaction in developing a partnership with an estate planning attorney that can be there for you down the roadwayPut simply, estate planning lawyers offer worth in numerous methods, much past merely providing you with printed wills, depends on, or various other estate preparing papers. If you have concerns regarding the process and intend to learn extra, contact our office today.

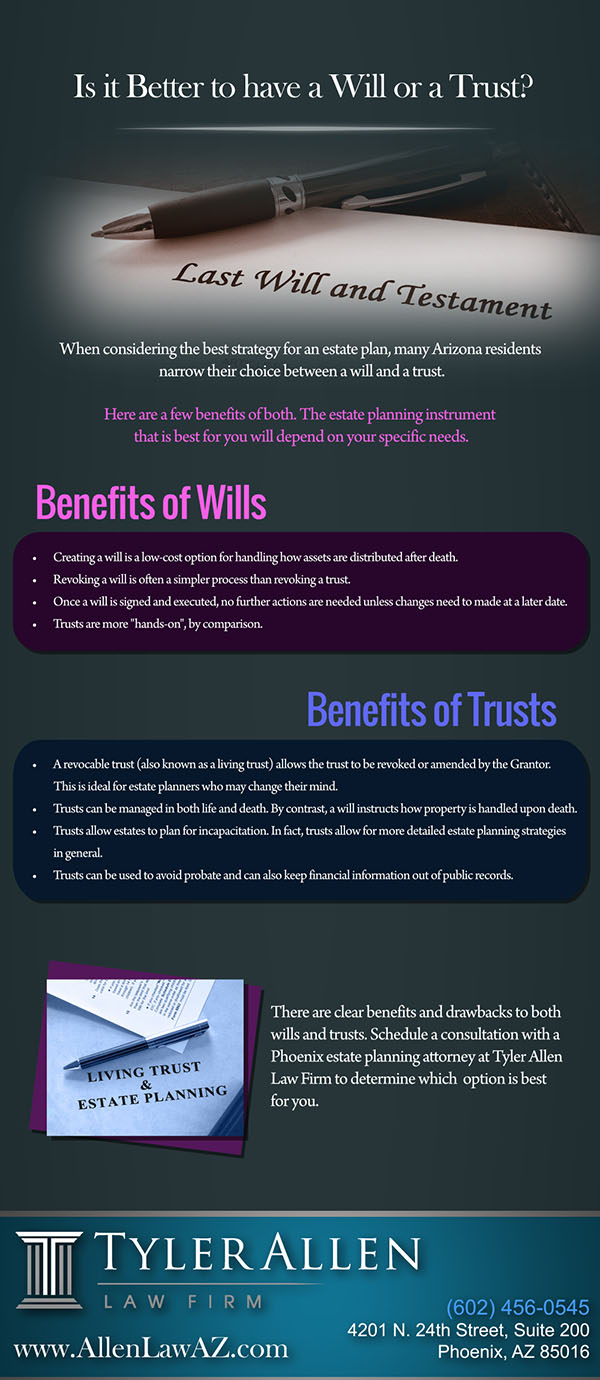

An estate planning lawyer aids you formalize end-of-life choices and legal documents. They can set up wills, establish depends on, create health and wellness treatment instructions, develop power of lawyer, produce succession plans, and extra, according to your wishes. Dealing with an estate preparation lawyer to finish and supervise this lawful paperwork can assist you in the following eight locations: Estate preparing lawyers are specialists in your state's count on, probate, and tax obligation regulations.

If you don't have a will, the state can determine how to split your possessions among your successors, which could not be according to your desires. An estate planning lawyer can aid organize all your legal documents and disperse your assets as you want, possibly avoiding probate. Lots of people compose estate preparation documents and afterwards ignore them.

The Ultimate Guide To Estate Planning Attorney

Once a customer dies, an estate strategy would determine the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions might be left to the near relative or the state. Obligations of estate coordinators consist of: Creating a last will and testament Establishing up trust accounts Naming an executor and power of lawyers Determining all beneficiaries Naming a guardian for minor youngsters Paying all financial obligations and reducing all taxes and lawful fees Crafting directions for passing your values Developing preferences for funeral arrangements Wrapping up guidelines for treatment if you become sick and are not able to choose Acquiring life insurance policy, impairment revenue insurance coverage, and long-lasting care insurance A good estate plan ought to be upgraded consistently as customers' economic circumstances, personal motivations, and federal and state legislations all evolve

Just like any occupation, there are characteristics and skills that can aid you attain these objectives as you deal with your clients in an estate organizer duty. An estate preparation profession can be right for you if you have the adhering to characteristics: Being an estate coordinator means thinking in the long term.

The Only Guide to Estate Planning Attorney

You have to help your customer expect his or her end of life and what will certainly happen postmortem, while at the exact same time not residence on morbid ideas or emotions. Some customers may come to be bitter or troubled when pondering fatality and it discover this info here could fall to you to aid them through it.

In case of fatality, you might be anticipated to have many discussions and dealings with making it through member of the family concerning the estate plan. In order to excel as an estate organizer, you might require to stroll a fine line of being a shoulder to lean on and the private trusted to communicate estate planning matters in a prompt and expert fashion.

tax code changed hundreds of times in the one decade in between 2001 and 2012. Expect that it has been altered even more considering that then. Relying on your customer's economic revenue bracket, which may progress towards end-of-life, you as an estate planner will need to keep your client's properties in full legal compliance with any kind of local, federal, or global tax laws.

The Main Principles Of Estate Planning Attorney

Gaining this qualification from organizations like the National Institute of Licensed Estate Planners, Inc. can be a solid differentiator. Being a member of these professional groups can verify your abilities, making you a lot more appealing in the eyes of a potential customer. In enhancement to the emotional incentive helpful customers with end-of-life planning, estate planners appreciate the advantages of a stable browse this site earnings.

Estate planning is an intelligent point to do despite your current health and monetary status. However, not many individuals understand where to begin the process. The first crucial point is to employ an estate planning attorney to aid you with it. The adhering to are five advantages of working with an estate preparation attorney.

An experienced attorney understands what information to consist of in the will, including your recipients and unique considerations. It additionally offers the swiftest and most efficient technique to move your assets to you could try here your beneficiaries.

Heath Ledger Then & Now!

Heath Ledger Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!